An Unbiased View of Hard Money Atlanta

Wiki Article

3 Simple Techniques For Hard Money Atlanta

Table of ContentsMore About Hard Money AtlantaHard Money Atlanta Things To Know Before You BuyFacts About Hard Money Atlanta RevealedFascination About Hard Money AtlantaThe smart Trick of Hard Money Atlanta That Nobody is DiscussingThe Best Guide To Hard Money Atlanta

If you can not pay back in time, you must re-finance the lending right into a standard industrial home mortgage to extend the term. Or else, you'll shed the property if you skip on your lending. Make sure to cover your bases prior to you take this financing alternative.Intrepid Private Capital Group provides FAST accessibility to tough money lenders and is devoted to giving our clients with an individualized solution that meets and exceeds their expectations for a pain-free financing procedure. Whether you are interested in new building and construction, property growth, flips, rehab, or other, we can help you get the funds you require quicker than most. hard money atlanta.

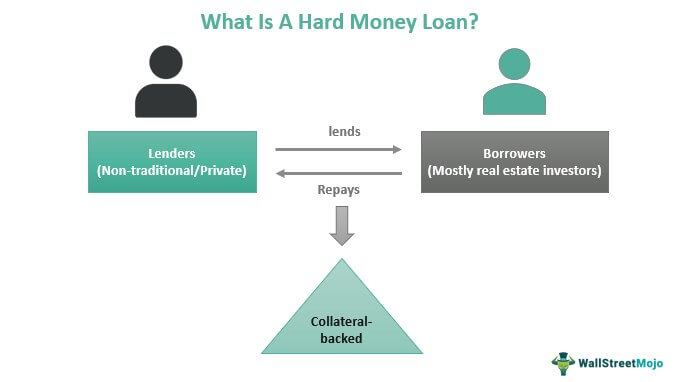

With conventional lendings, loan providers normally inspect the debtor's capacity to repay the financing by looking at his or her credit rating, FICO credit rating score, debt-to-income proportion, and so on. While some hard money lenders might still take these variables right into factor to consider, most base candidacy on the value of the residential property. The borrower, for example, might position a residence or residential or commercial property that she or he possesses - partly or fully - up for security.

The Best Strategy To Use For Hard Money Atlanta

Allow Intrepid Private Resources Team help you obtain the personal funding that you require for your organization or task. That Requirements a Difficult Money Lending? While any person can apply for a difficult money funding, they are best matched for the following: Home flippers Buyers with poor credit rating Buyers with little-to-no credit report Investor Residential property developers What is the Loan-to-Value Proportion When taking into consideration a tough money car loan, you must pay attention to the charges, financing term, as well as most importantly, the loan-to-value proportion.

Call United States for Extra Info Do not hesitate to contact us with any type of concerns you have (hard money atlanta). Our friendly team is all set to assist you get your job off the ground!.

Examine This Report on Hard Money Atlanta

Hard money lending can be lucrative, yet similar to any type of organization, the chances of productivity rise when particular conditions are met. Hard cash borrowing is most likely to be rewarding when: The lender understands the property market in the locations where it runs. The loan provider can successfully identify, underwrite, take care of, as well as anonymous service financings.Be sure you recognize as well as comply with any applicable regulations and also needs. If you purchase a hard cash offering fund, check to ensure the fund abides by suitable laws as well as demands. If you decide to end up being a hard cash lending institution, either directly or through a fund, be sure to recognize the pertinent profits and costs, the two vital chauffeurs of profitability.

Not all tough money lenders charge all these charges. Tough money lenders sustain costs, official statement consisting of underwriting car loans, servicing car loans, reporting, marketing to borrowers as well as investors, and also all the prices that include running any service, such as paying for workplace and also utilities.

The Hard Money Atlanta Diaries

As hard money lenders in Arizona, we are typically asked if we function like standard financial institutions.A real hard cash copyright has a resource of straight funds, and no intermediary to manage your financing. We solution as well as underwrite all of our very own financings, supplying funds for your investment purchase on part of our financiers.

Following time you apply for a personal home mortgage funding, ask if the broker is a straight lender or if he is simply the co-broker., like Resources Fund I, is that we carry out all underwriting, documents, and signings internal, consequently we can fund financings in 24 hours as well as also quicker in some circumstances.

Unknown Facts About Hard Money Atlanta

The security is the only point that is underwritten. Because of this as well as the personal nature of the funds, these kinds of loans are generally able to be funded in very short time frames. The main differences in between Hard Cash and also Traditional or Institutional Providing are: Higher Rate Of Interest Rate Shorter Funding Term Larger Down Repayment Requirements Quicker Funding Financing Because of the fact that Hard Money lenders do not finance the Consumer their comfort level with the funding originates from equity (or "skin") that the Debtor puts in the deal.With this in mind, the Hard Cash loan site web provider wants to keep their funding total up to a number at which the building would most likely sell if it was required to trustee sale. Personal loaning has emerged as among the safest and also most trustworthy forms of funding for financial investment house purchases.

As a trustee purchaser, you don't have a whole lot of time to decide and also you most definitely can't wait around for the traditional financial institution to money your finance. That takes at the very least 30 days or even more, and also you need to act fast. You may simply opt to make use of cash on hand when you most likely to the trustee auctions.

The 45-Second Trick For Hard Money Atlanta

A hard money loan is a nontraditional, protected financing provided by an investor to a purchaser of a "difficult possession," normally genuine estate, whose credit reliability is lesser than the value of the possession. Hard money loans are extra usual for real estate investments purchasing a rental home or turning a home, as an example as well as can get you money quickly.Report this wiki page